life insurance face amount vs death benefit

In most cases the. This means that if you pay 500 premiums for a 100000 term life insurance policy.

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Death Benefit - If you are looking for an online quote provider then we have lots of options waiting for you.

. Face value is the amount that the insureds family or beneficiaries receive upon death of the policy owner. Your cash value will always equal your death benefit by age 100 hence if your. In this article our life insurance lawyers answer all of these questions to help people understand what rights they have over the death benefit if they discover they are policy.

In some cases the face amount and. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your. The face value is also known as the death benefit.

The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim. The initial amount of money claimed by the beneficiaries on account of. The beneficiary receives both.

When you pass away the death benefit your loved ones receive will be the face value of the policy. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. It refers to the initial coverage amount of a policy.

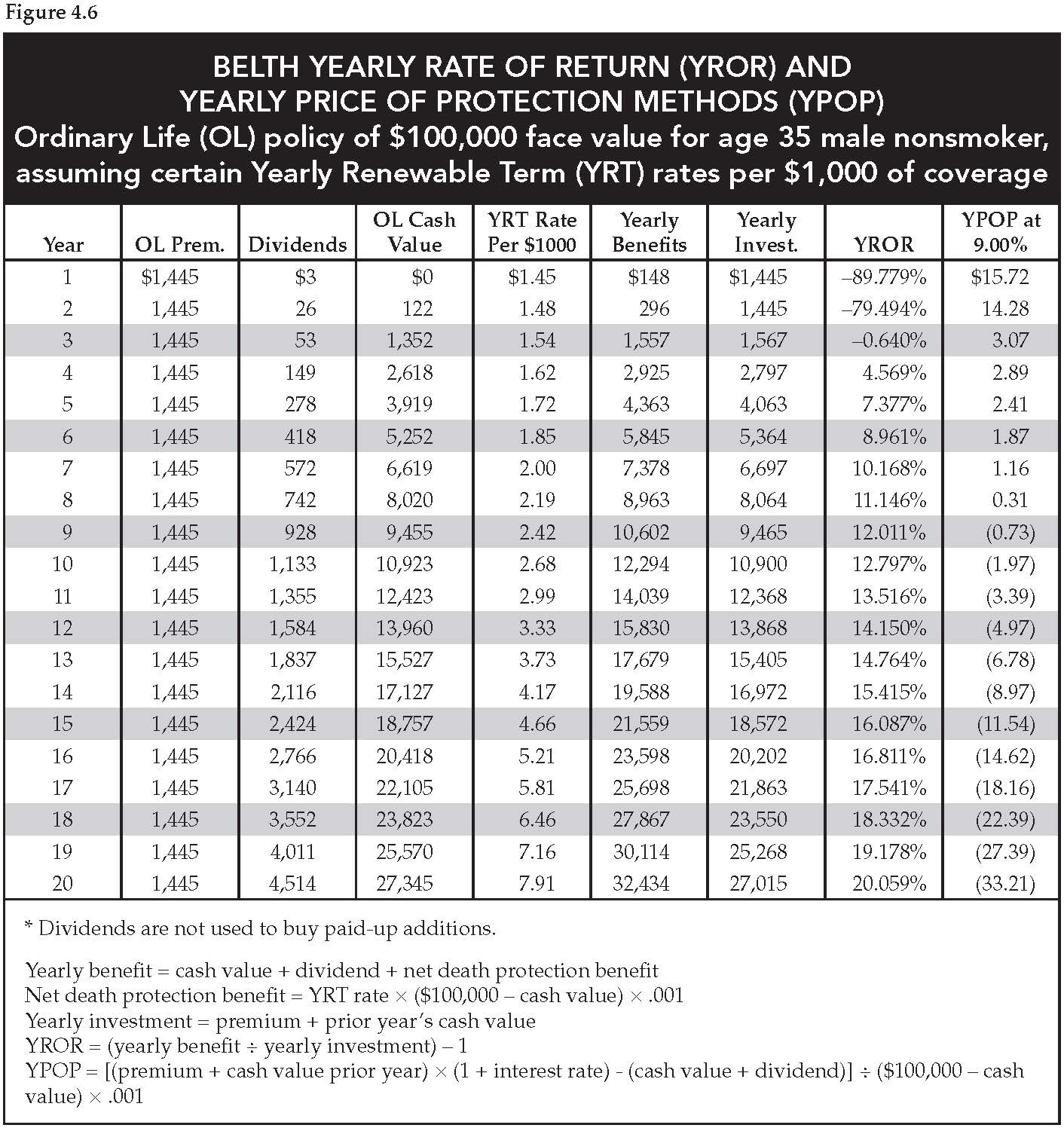

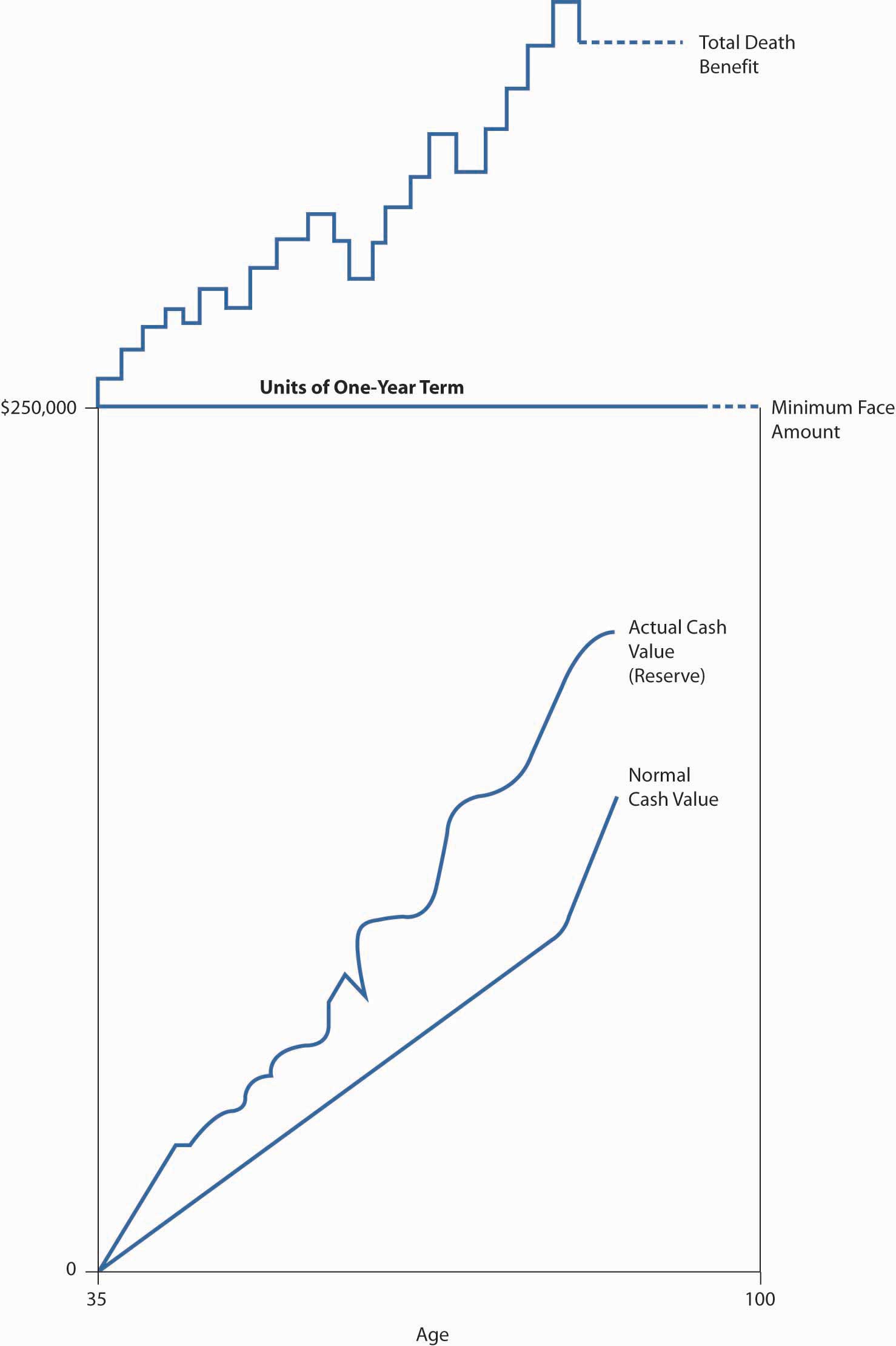

Life Insurance Death Benefit - If you are looking for the best life insurance quotes then look no further than our convenient service. In this way the death benefit indicates the potential of your Whole Life insurance policy as a savings vehicle. The death benefit is the amount of money that is paid out when a valid life insurance claim is filed.

Death benefit proceeds paid to your beneficiaries in a lump sum whether a person or an institution is not subject to a taxable income. April 30 2021. The face amount is.

Face Amount vs Death Benefit. If you died owning a policy with a 200000 in. With some types of life contracts whole universal the face amount can grow a higher death.

The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy and its a primary factor in determining the amount of. Home Answers what is the difference between the face value and death benefit in whole life policy Asked July 10 2015. Keep in mind that face amount and paid death benefits are similar.

Death benefit insurance for seniors. The death benefit is paid to the stated beneficiaries of the. At the beginning of the policy the face value.

The term Face Amount is similar in nature. Face amount vs death benefit death benefit whole life insurance. So if you buy a policy with a 500000 face value in most.

Simply put the life insurance face value also called the death benefit is the amount that your beneficiary will receive when you die.

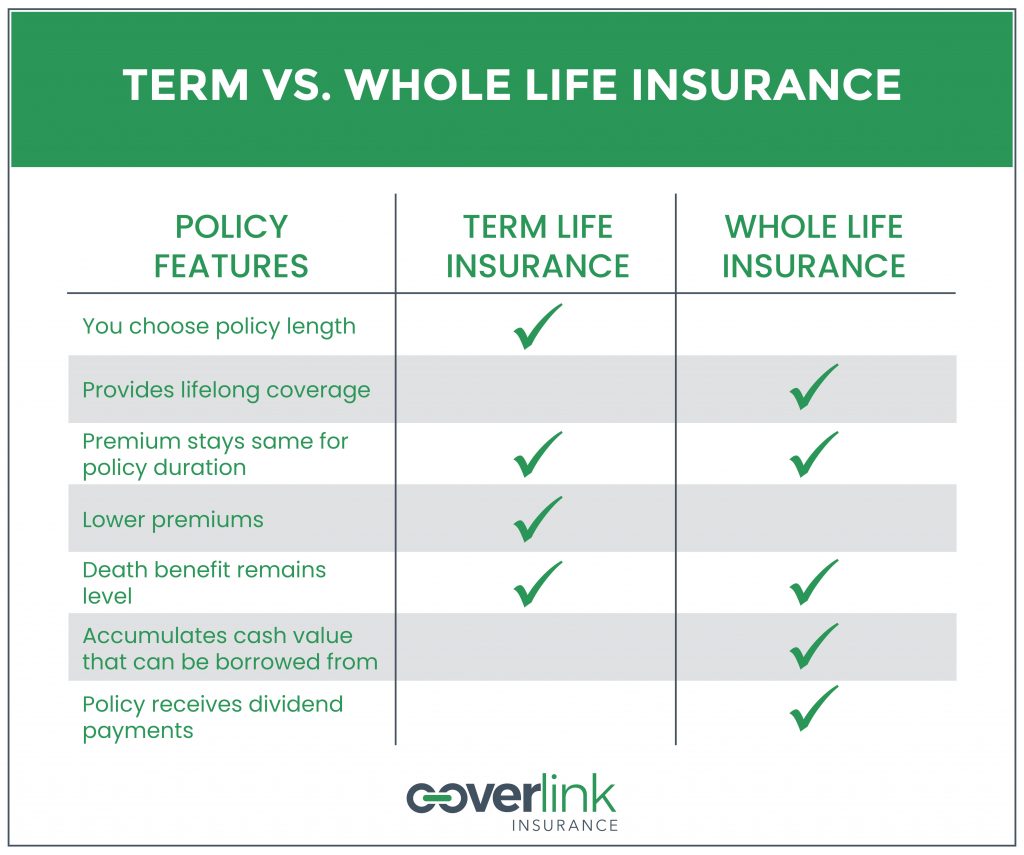

Term Whole Life Or Return Of Premium Life Insurance How To Choose Coverlink Insurance Ohio Insurance Agency

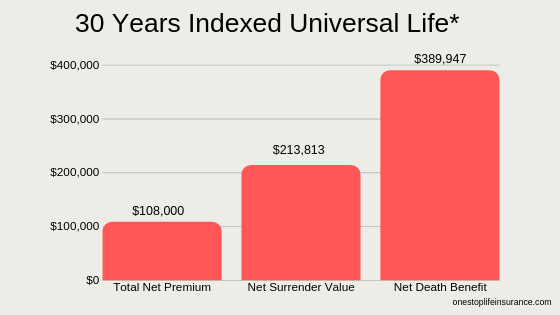

Flexible Planning Options With Universal Life Insurance Agency One

Life Insurance Death Benefit Options

How To Rescue A Life Insurance Policy With A Loan

Are Living Benefits And Cash Value The Same Thing 2021

How To Compare Life Insurance Policies Benefitspro

Whole Life Insurance State Farm

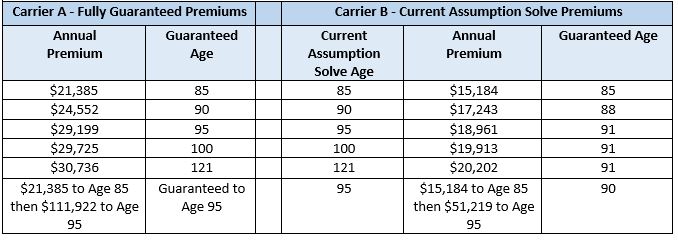

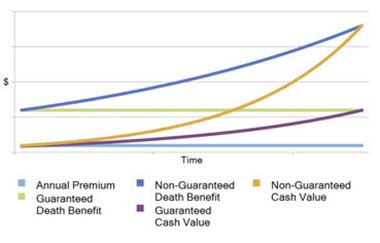

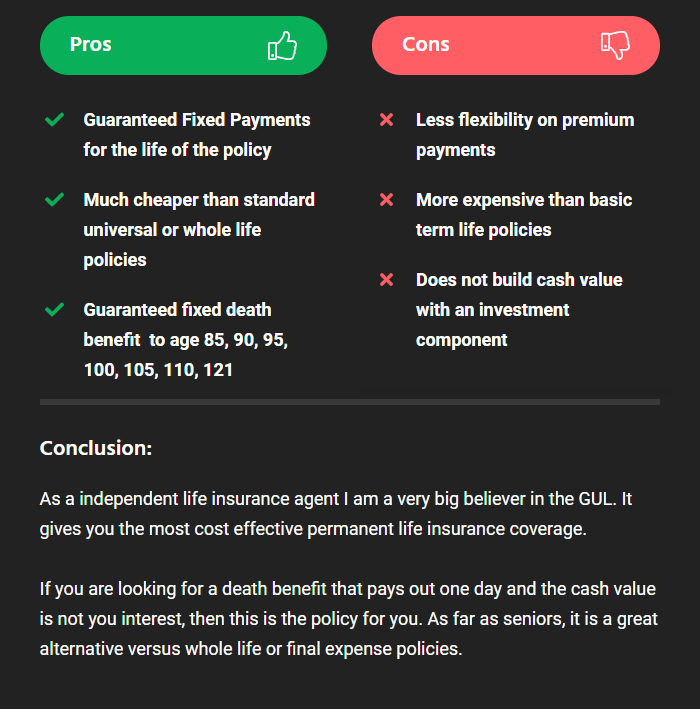

Non Guaranteed Vs Guaranteed Universal Life Insurance Pros And Cons Must Read Pinnaclequote

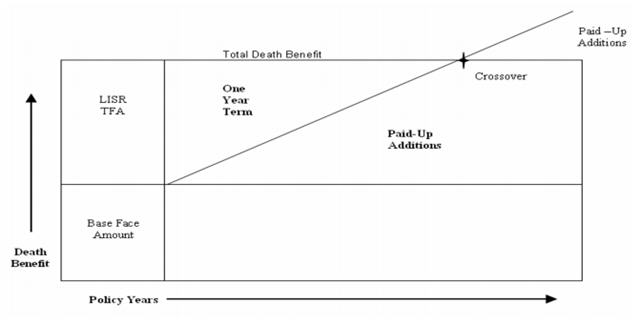

Massmutual Whole Life Legacy 10 Pay With Lisr Review

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

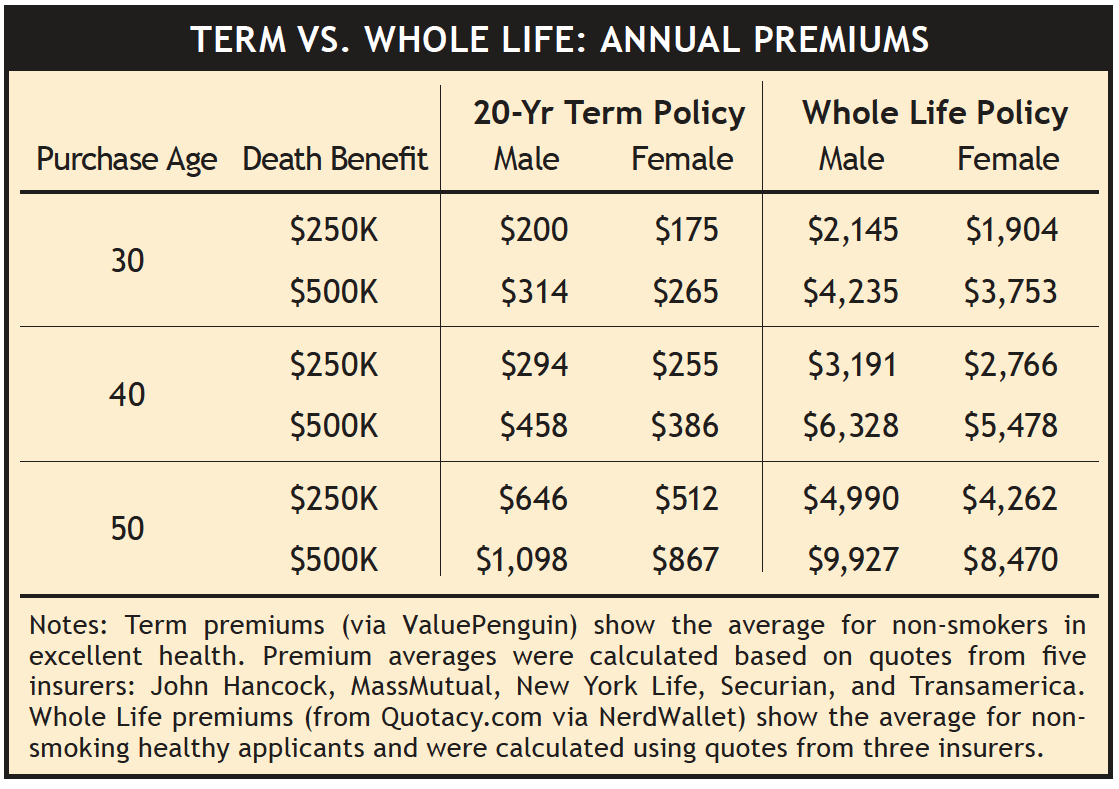

Term Vs Whole Life Insurance What S The Difference

Modified Whole Life Insurance 4 Things They Don T Tell You

How Cash Value Life Insurance Works

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons

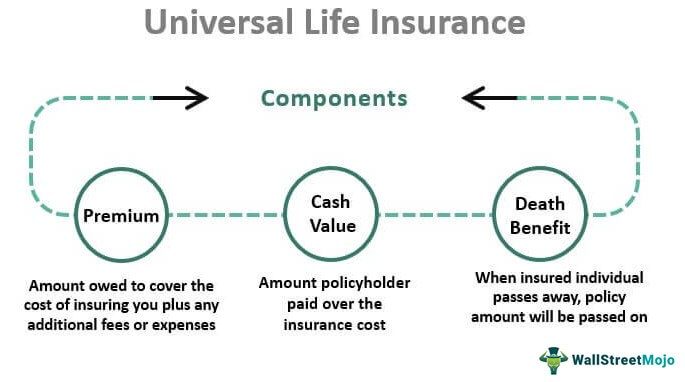

Universal Life Insurance Definition Explanation Pros Cons

Life Insurance Which Kind Is Right For You Sound Mind Investing

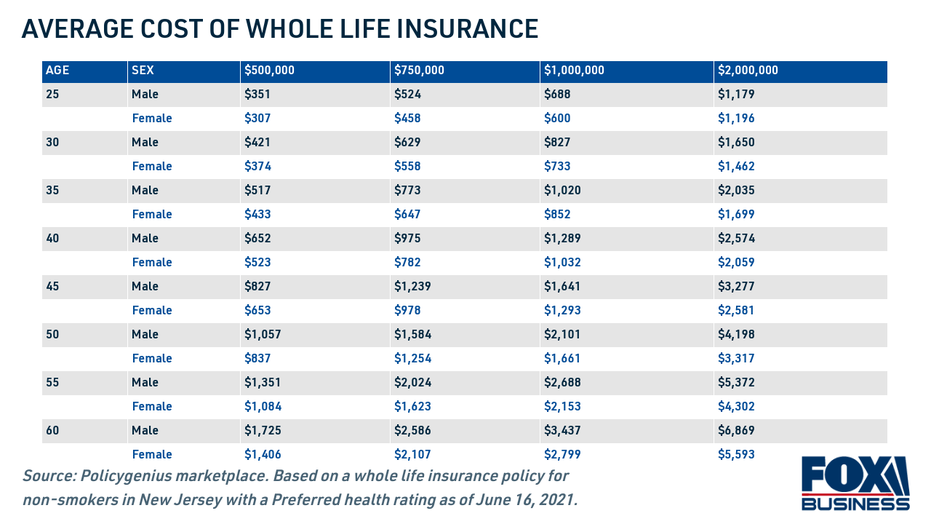

How Much Should Life Insurance Cost See The Breakdown By Age Term And Policy Size Fox Business

Mortality Risk Management Individual Life Insurance And Group Life Insurance

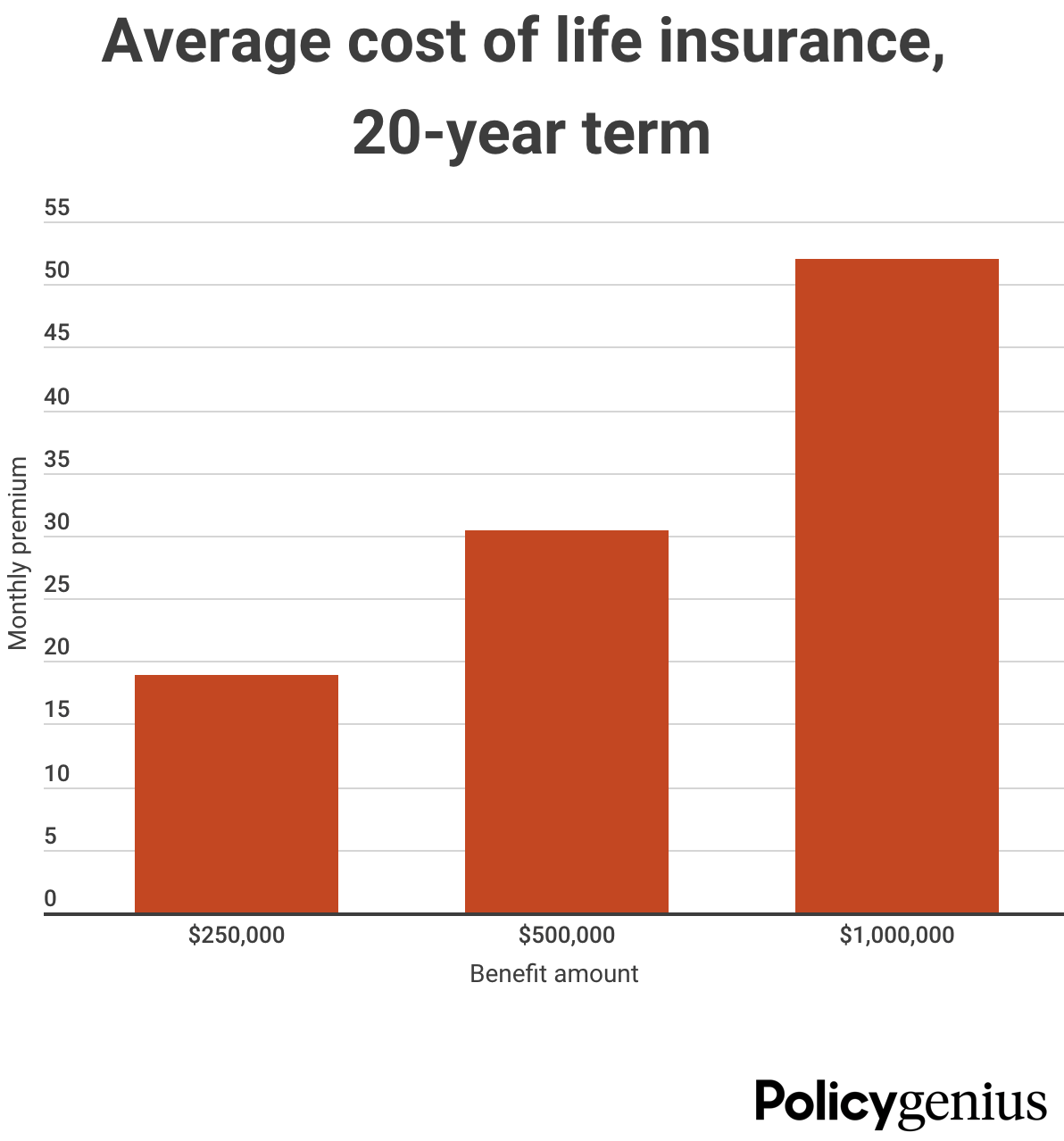

Average Life Insurance Rates By Age Term Coverage Of November 2022 Policygenius